Products

Services

December 14, 2017

If you’re a physician, then you’re probably aware of the Merit-Based Incentive Payment System (MIPS) that rewards good performances with bonus payments and disincentivizes poor performances through penalties.

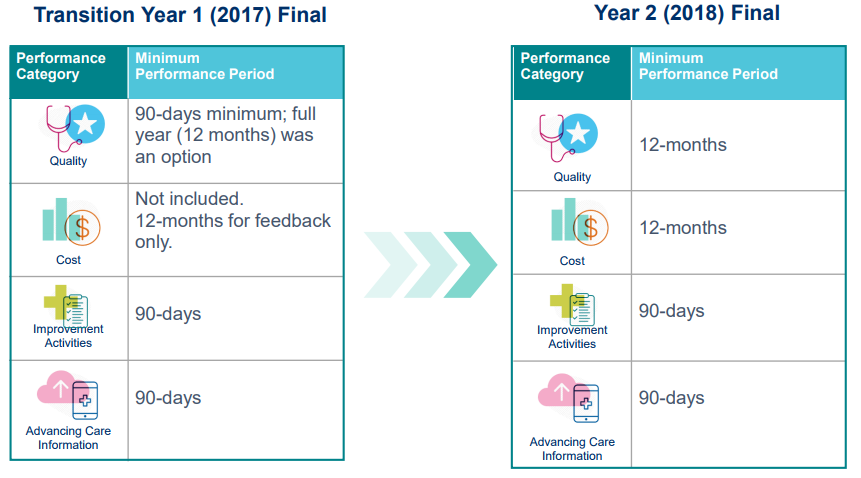

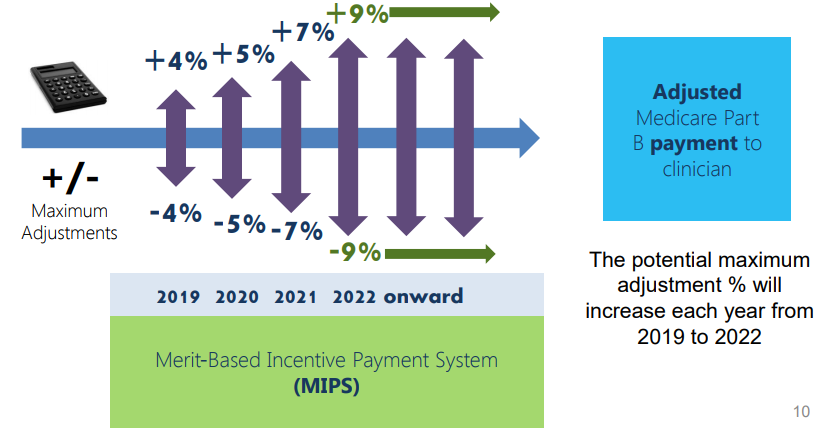

For 2017, the bonuses and penalties to be distributed in 2019 are -4% to +4X% where X is the possibility for a bonus adjustment factor based on how well your practice performed with MIPS that allows the program to stay budget neutral. There will be some changes to 2018 MIPS Reporting and the image below gives a very basic outline of minimum reporting requirements for each category.

For 2018, the bonuses and penalties to be distributed in 2020 are -5% to +5X% where X is the possibility for a bonus adjustment factor based on how well your practice performed with MIPS that allows the program to stay budget neutral.

Because MIPS can have a noticeable impact on your bottom line, we suggest you…

The one thing a physician owned-practice can do to position their business for a bonus is to adopt the proper software and designate a professional management company to handle their MIPS reporting. Utilizing 2015 CEHRT Software and conducting full 2018 calendar year reporting will definitely put a practice on the right track. Achieving a final score of 16 points or more will likely result in a bonus payment, while better reporting means more points, translating into an even higher bonus. The sooner you get started and used to the process, the more prepared your practice will be to achieve greater bonuses in the future with MIPS since the potential maximum % adjustment will increase each year from 2019-2022 (the years the bonuses/penalties will be distributed).

Utilizing 2015 CEHRT Software and conducting full 2018 calendar year reporting will definitely put a practice on the right track

CMS estimates that MIPS eligible providers will receive approximately $173 million in bonus adjustments for the reporting year of 2018. This number rockets to an additional $500 million for exceptional performing practices with scores of 70 or higher. The average provider earning $130,000.00 in Medicare Part B income and a MIPS score between 15 and 69 will receive an estimated reward of $324, while an excellent MIPS score between 70 and 100 will land a $1,173 bonus.[1] Approximately 77% of eligible clinicians will reach the exceptional performance level.

CMS estimates that MIPS eligible providers will receive approximately $173 million in bonus adjustments for the reporting year of 2018.

On the other hand, CMS also forecasts that 3.9% of providers will get hit with a penalty. The average provider not reporting MIPS will face a negative payment adjustment of $6,500. The good thing is that CMS makes avoiding the penalty fairly easy by setting the performance threshold at only 15 points, resulting in no bonus and zero penalties.[1]

The average provider not reporting MIPS will face a negative payment adjustment of $6,500.

Proper MIPS reporting is essential to a physician-owned practice. The Max/Min is set to jump to +/- 9%, with an even greater potential positive adjustment for the reporting year 2020.1 This could result in either big bonuses or adverse fees. To help your business capitalize on MIPS, get your practice started today. Request more information from a ChartLogic Specialist here.

Sources:

[1] https://mdinteractive.com/2018-mips-rules